What Really is ESG Investing?

Aug 25, 2022

Thinking about personal finances can be stress-inducing and the world of finance is often filled with jargon and risk factors that would dissuade even the biggest risk taker. As someone who is just getting started in their journey through investing, I have been doing research on how big banks invest, and how where we choose to put our money can potentially impact climate change. I’ve heard little conversations here and there about ESG Investing and at face value, it sounds like a sustainability supporter’s dream. However, it seems that ESG investing may not be the answer to our climate woes as we thought it would be.

Through this article, we do not seek to offer financial advice. We will be exploring what ESG investing is, what it was designed to do, how successful it is in holding organizations accountable, and what it all means for climate action.

It’s also worth noting that the world of banking has been facing criticism for its inflexibility to shift away from fossil fuels. I won’t dive too far into this, but this Vox article highlights some of the struggles between climate activists and big banks. If you’re wondering what banks are categorized as “sustainable,” check out this list. There’s great information listed, including B-Corp status, fossil-fuel engagement, and GABV membership standing.

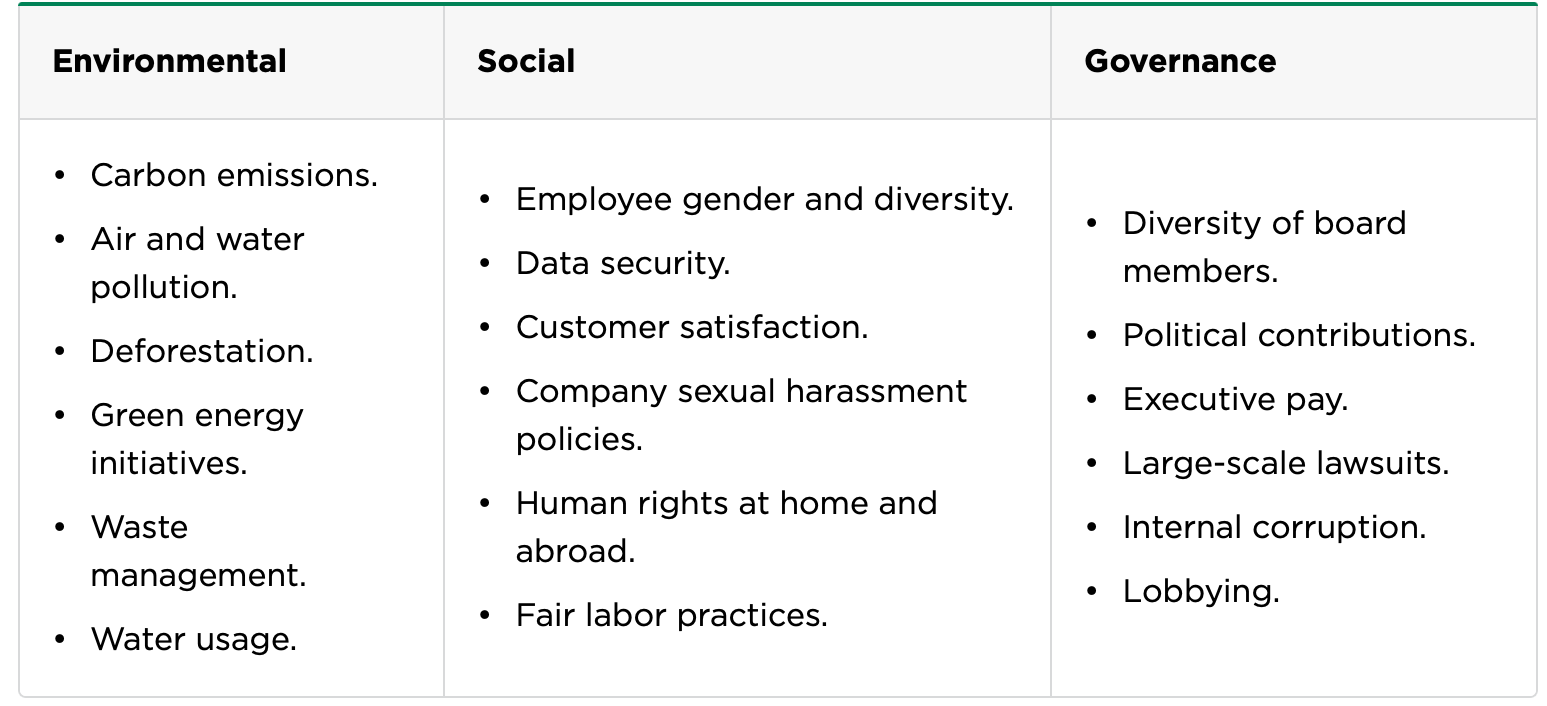

According to NerdWallet (linked above), ESG investing is “a form of sustainable investing that considers environmental, social and governance factors to judge an investment’s financial returns and its overall impact. An investment’s ESG score measures the sustainability of an investment in those specific categories.” Here is a breakdown of some things that ESG takes into consideration:

Image from NerdWallet

All of this sounds great - how could investing in organizations that prioritize these three areas be problematic?

ESG Funds are scored using ESG ratings, which according to HBR, are “based on ‘single materiality’ ” — the impact of the changing world on a company’s profits and losses, not the reverse.”

Simply put, HBR is stating that ESG ratings are based on a company’s resiliency to climate change and the impacts that stem from it - resulting in the financial success of the company. It does not address how a company itself could be driving climate change. For this, we would need a double materiality approach.

HBR continues with a number of downfalls associated with ESG investing and includes some of their recommendations for what is needed to create a better system, all of which I encourage you to read, but let’s pivot to another influential voice in the world of finance - Tariq Fancy.

In a 4-part series, Fancy, who is the ex-CIO for Sustainable Investing at BlackRock, takes a clear stance on sustainable investing. One thing that is overarching throughout his series is that ESG investing, although it’s been around for a while and gone through numerous iterations, is still in its infancy. We don’t have any clear boundaries or guidelines for what ESG investing truly is, who it benefits, and how it should work. That being said, here in the U.S. the SEC (Securities and Exchange Commission) has thrown its hat in the ring to try to reign in how we define ESG investing.

That said, ESG - while sounding great - is under a bit of a microscope right now.

In a new attempt to crack down on greenwashing in the finance sector, Bloomberg reports that “under Chair Gary Gensler [...] officials have been demanding that money managers explain the standards they supposedly use to classify ESG-labeled funds. When the examination division spots potential misconduct, it typically alerts the agency’s enforcement unit for further investigation.” All of this gets a little tricky because, as I said in the previous paragraph, ESG isn’t clearly defined.

Even more confusing - who’s responsible for defining what ESG investing is and isn’t? I leave this with you to think about - I’m not sure where my opinion on this matter lays.

One thing I can say for sure is that this topic will continue to appear in the news and may cause stress for publicly traded companies. Nobody wants to be accused of or found guilty of greenwashing - I think we’ve all seen how Higg and H&M have been raked over the coals the past few months. It seems the only way to create a truly sustainable and transparent system for ESG investing is for companies, market managers, and the SEC to collaborate. Maybe through redefining what ESG investing is, creating guidelines to follow, and truthfully communicating the ESG success of a company will create a more harmonious system. All of this would take time and effort from all parties involved, but it doesn’t seem too far out of reach.

On a smaller scale, what can we do to ensure we’re not getting stuck in this trap?

- If you’re investing in an ESG Fund, see if you can get the names of all the organizations featured in that fund - make your own judgments about their sustainability efforts

- Not currently in the “investing game?” Think about the bank you’re simply “banking” with…where’s that money being put to use? Have you heard of the Fossil Free Banking Alliance? Is yours a part of it? For example, The Underswell banks with Amalgamated, who’s not on their list, but is a Certified B Corp and committed to a lot of great issues.

- Continue to research ESG investing - there’s a ton of information out there and we’ve only covered the tip of the iceberg!

- How does your brand communicate sustainability efforts? Check out this video Derek did to learn more about why communication is so important

The world of sustainable finance is vast and I appreciate you sticking with me to the end. Like so many of the topics we cover, we understand this can be overwhelming, but we encourage you all to #keeplearning - after all, we can’t fix what we don’t know!

If this is a topic of interest to you, we plan to continue this conversation in our Academy. If you’re not currently enrolled and would like to learn more about it, please email us at [email protected]. We’d be happy to give you the 411 on this unique offering!

Have you already explored ESG investing? What surprised you most about this topic? Share your thoughts in the LinkedIn Group.

Talk soon,

McKenzie

#keeplearning #finance #sustainability #ESG